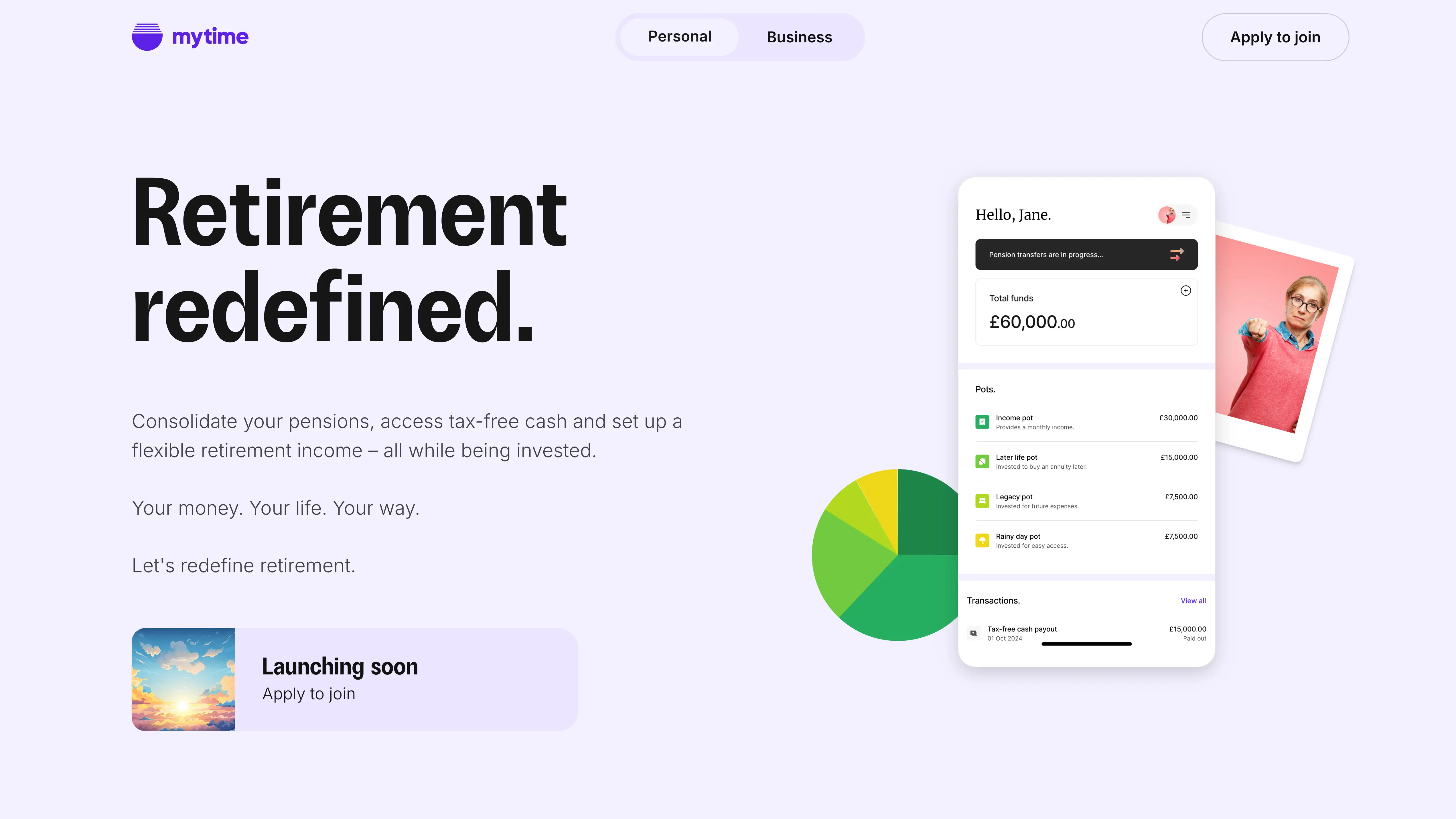

Digital retirement platform My Time has received direct authorisation from the UK’s Financial Conduct Authority (FCA), effective 5 January 2026, with regulatory permissions covering investment and pensions activities.

The London-based business was co-founded in 2023 by Paul Budgen and Elliott Silk. It is focused on what the founders describe as a structural “market failure” in the pensions industry: the decumulation phase, when individuals with moderate pension funds begin accessing their retirement savings.

Commenting on the authorisation, co-founder and MD Paul Budgen said:

We are an innovative new entrant into a market desperate for new ideas. We have worked hard, hand in glove, with the FCA approvals team. We see this as the gold standard stamp of approval. It will help us attract clients, staff and investors as well as advisers who wish to access our solution.

My Time is designed for scale and to help individuals manage the transition from saving for retirement to safely accessing their modest pension funds. While much of the industry has historically focused on higher-value pension pots and accumulation, the company is targeting the more complex and risk-prone process of decumulation. It uses behavioural science and choice architecture to simplify complex decisions, presenting users with a small number of clear options while managing the underlying governance.

My Time incorporates artificial intelligence for identity verification and fraud detection, including spotting deepfake imagery and falsified documents. It also uses AI-driven customer service tools to handle routine queries before escalating customers to human support. It has developed SmartAnnuityAi to determine the best time to purchase an annuity. For users nearing retirement, the company prioritises human interaction, deliberately recruiting staff who will ensure tone and reassurance are appropriate for its core demographic.

My Time positions itself for individuals with combined pension pots of between £30,000 and £250,000 who are typically disenfranchised from the traditional one-to-one advice model, describing its approach as a “do it with me” model designed to bridge the industry’s advice gap. My Time can also be accessed by advisers wishing to help their clients with modest pension pots create a sustainable income in retirement.

My Time is well placed to take advantage of the new Targeted Support regime, due in May 2026, and to help Workplace Pension Scheme Trustees with the new obligations from the Pension Schemes Bill, which seeks to introduce a default income in retirement proposition for scheme members.

The company’s regulatory responsibilities are overseen by Chris Bradley, who holds both the SMF16 Compliance Oversight function and the SMF17 Money Laundering Reporting Officer roles.

My Time has raised equity investment from angel investors to support the early development of its technology and team.