The UK's financial services industry is one of the most regulated in the world, with the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) keeping track of thousands of firms and individuals. Drawing on data from the FCA's Financial Services Register (FS Register), this snapshot offers an up-to-date look at the industry. The FS Register, a public database maintained by the FCA, tracks firms and individuals subject to regulation by the FCA. It provides near real-time insight into the size and structure of the UK financial services industry.

A snapshot of FCA-regulated firms

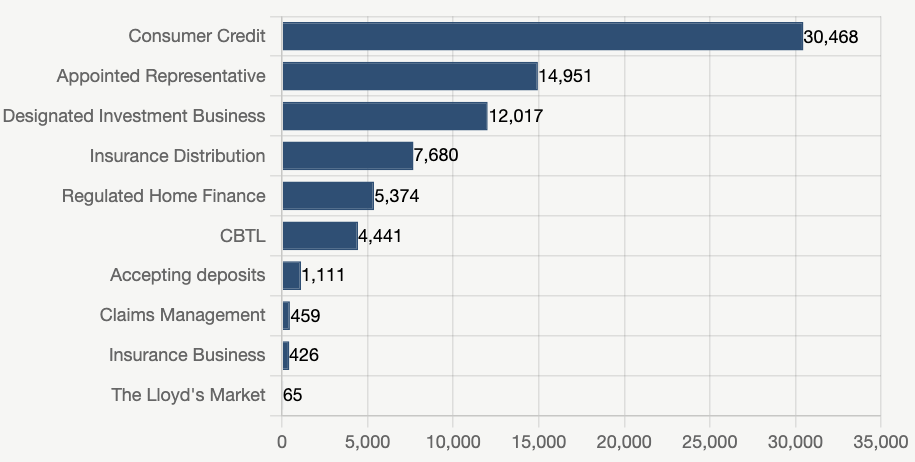

As of the 19th of September, the UK boasts 73,921 financial services firms that are regulated by the FCA. These firms span a wide range of financial activities, from consumer credit to insurance distribution. Below is a breakdown of the top 10 activity categories by the number of active firms.

Top 10 activity categories by number of active firms (September 2024)

Consumer Credit is the largest category, with over 30,000 active firms, reflecting the market for credit services across the UK. Other populated categories include Appointed Representatives—firms or individuals that carry on regulated activities under the responsibility of an authorised firm, known as the "principal". There are also a significant number of firms with some activities in Designated Investment Businesses, covering firms providing a wide range of investment products and services.

Controlled functions: who's in charge?

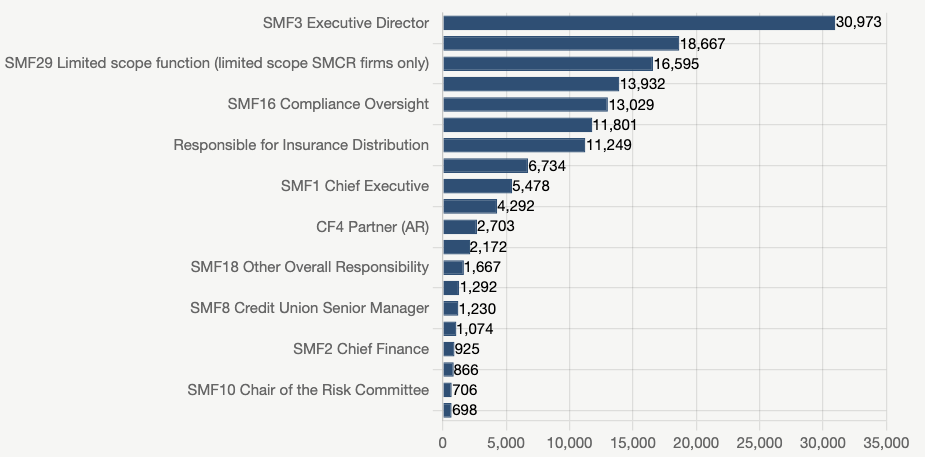

The FCA does not just regulate firms—it also oversees the individuals who play key roles within these firms. These individuals hold "controlled functions," which carry significant responsibilities for ensuring compliance with FCA regulations. There are over 181k individuals holding controlled functions. Below is a look at the top 20 controlled functions by the number of individuals performing them. This includes functions under the Senior Managers and Certification Regime (SM&CR) and the Approved Persons Regime (APR). The FCA has been introducing the SM&CR since 2016; however, the APR still governs appointed representatives of SM&CR firms 1.

Top 20 controlled functions by number of individuals (September 2024)

The most common function, by a large margin, is SMF3 Executive Director, with over 30,000 individuals holding this position. This role involves acting as a director of a firm, excluding non-executive directors. If the firm's main purpose is to conduct regulated activities, all directors are classified under this function. For firms with broader purposes, only directors responsible for regulated activities fall into this category.

The CF1 Director (AR) function applies to individuals serving as directors (again, excluding non-executive directors) of appointed representative firms. The large numbers in this category reflect the significant presence of appointed representative firms, particularly in sectors like investment advice and credit broking.

Ranking third is the SMF29 Limited Scope Function. It is a senior management role specific to firms with restricted permissions, such as consumer credit firms and sole traders 2.

Beyond this snapshot, the FS Register provides significantly more timely data on the UK's financial services industry, offering immediate insights into the structure and scope of regulated firms and individuals.

Footnotes

-

Senior Managers and Certification Regime (SM&CR) and Approved Persons Regime (APR) details: LexisNexis guidance. ↩

-

Specifics on Limited Scope Function roles: FCA Handbook. ↩